Andrew spoke on Implications for the Belt & Road Initiative hosted by the Asia Securities Industry & Financial Markets Association (ASIFMA) in Hong Kong on 26 September.

The big picture is, well, big. The Asian Development Bank (ADB) has updated its forecast of what its 45 Developing Member Countries need to spend in order to maintain recent growth momentum, mitigate and adapt to climate change and eradicate poverty by the UN’s Sustainable Development Goal target date of 2030. It’s $1.7 trillion. Per year. At the same time, financial institutions are allocating further funds to infrastructure in pursuit of low volatility, long – dated and inflation – linked returns. Worldwide, the IFC estimates this dry powder at a scarcely credible $110 trillion, 80% of which is needed in developing markets. The Global Infrastructure Hub (GIH) chimes in with a $4.6 trillion gap between what is needed in Asia out to 2040 and current levels of investment.

Yet only a fraction of this potential is being realised for the long-standing reasons of host governments’ ineffective legal and regulatory regimes, an inability to procure then clear the required land in a sensible timeframe at sensible cost; insufficient project design and preparation; and a forlorn hope that not very much government support will be needed, notwithstanding the first P in Public Private Partnerships (PPP). (Marsh & McLennan for the GIH estimate that 55 – 65% of projects being proposed in Asia lack sufficient support from host governments and / or multilateral agencies to be bankable in the eyes of the private sector.)

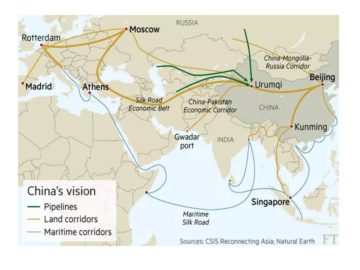

This munificence has been mostly conducted on terms with Chinese characteristics when it comes to both safeguards for Corporate Social Responsibility and credit risk, be this political or commercial. But, according to one report, Chinese officials privately expect to lose 30 percent of their investments to date in Central Asia, 50 percent in Myanmar – and perhaps 80 percent in Pakistan with its China – Pakistan Economic Corridor (CPEC) linking the port of Gwadar in Balochistan to Xinjiang province, to which China has committed some $54 billion. So there are limits to the depth of even China’s pockets and, both for the quality of its own book and so as to get anywhere near its targets, the envelope of what is meant by bankable needs to shift from that with Chinese characteristics to international best practice and thus crowd in funds from outside China.

There are signs that this is beginning to happen.

First, the IFC’s managed co-lending portfolio program (MCPP) has to date invested some $3 billion. Funding initially came from China’s State Administration for Foreign Exchange (SAFE) with $3 billion but private sector Allianz and Prudential’s Eastspring have also contributed, as has Hong Kong’s Monetary Authority (HKMA) with $1 billion (admittedly less than 0.25% of its Exchange Fund reserves). Singapore’s trade development board, IE Singapore, similarly envisages co-funding up to $22 billion alongside China Construction Bank.

Second, the occasional international bank (there are not many still open for business in Asian infrastructure) such as StanChart is increasingly financing projects sponsored, built and operated by Chinese players.

Third, Beijing’s National Development & Reform Commission (NDRC) has recently warned against what the West would term irrational exuberance when it comes to further investment. It will expect to be obeyed.

Meanwhile, the Asian Infrastructure Investment Bank (AIIB), armed with $100 billion of capital, is now structured, staffed and looking to behave like its predecessor development banks so will be taking only international best practice risk. So, too, the New Development Bank (a.k.a. the BRICS bank) if on a smaller scale.

The rest of the World has not stood idly by. In 2015, Japan, long the leading investor in Asia, responded by pledging a cool $110 billion of its own to infrastructure in Asia. Other countries such as Russia, Iran and Turkey have more domestically foc

All this money, from both China and elsewhere, is welcome but the yawning gap between host governments’ and the outside world’s expectations as to what constitutes a reasonable balance of risk and reward, remains.

As I wrote in May, BRI first needs to not just invest / lend but also assist host governments prepare the projects in the first place (or, even better, pay the likes of Logie Group to do so). Whether financed via sovereign lending or directly as projects, the infrastructure still needs to be designed, sized, connected and located. If financed on anything less than at a sovereign level, host governments need to design legal and regulatory environments then perhaps offer appropriate government support – which involves determining how to structure, allocate, ration and recycle it. But these challenges have been scratched in only a handful of countries: the ADB estimates that a whopping 92% of infrastructure investment across Asia is still spent by the public sector.

Second, BRI needs to address the commercial and political risks of doing business in some pretty exotic markets. It would be unrealistic to expect Beijing to take all such risks but it can, to some extent, address them, again by assisting host governments to raise their reliability / credit worthiness … which is ultimately pretty much the same point.

Appetite from the private sector will be continue to be led by developers, contractors looking to create a customer and their compatriot banks in support alongside domestic banks when in their own back yard. Opportunities for the capital markets to take original project risk (as distinct from lending to or investing in some safer intermediary) will remain limited unless they are prepared to take more risk than previously. Thus, this year saw a thumping $2 billion bond to refinance Paiton Energy on 12 and 20 year tenors . But this Indonesian IPP was first financed twenty years ago, indeed it was a leading player in the Asian financial crisis. If this swallow is to an Aristotlean summer make, much more needs to be done on sculpting the risk offered to and accepted by the capital markets. Again, this is what Logie Group does and I have several policy suggestions on this which will need to wait for a later opinion piece.

Back on BRI specifically, no doubt much will go wrong. There are good reasons why the rest of the World has invested little in many of these countries. Technologies such as high-speed rail are fantastically expensive. Rail over distances such as that from Xian to London are not competitive against sea or air (or road). Not even BRI will soak up all of China’s overcapacity. China’s contractors are still learning how to manage projects away from home. Tales of waste and corruption will abound. There has been almost no discussion on how much of BRI will be denominated in RMB and how this currency exposure might be hedged. Pointedly, one session at the HK Trade Development Council’s Belt & Road summit on 11 September was on the positively rosy prospects for dispute resolution.

But, by the same token, much will be financed and, over time, repaid. Exciting deals are happening – last month, Shanghai Electric and Saudi Arabia’s ACWA Power won the bid to build an AED 14.2 billion ($ 3.8 billion) 700 MW Concentrated Solar Power (CSP) plant in the UAE, the largest and cheapest (output price is to be 7.3 US cents per kWh) of its kind in the world.

So watch this space for the next twenty years.

Thanks very interesting blog!

Thank you for the excellent post