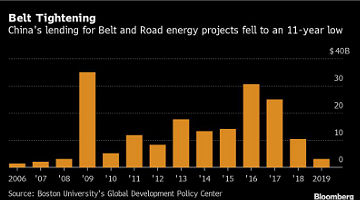

Bloomberg reports data from Boston University’s Global Development Policy Centre which tracks lending by China’s two main policy banks. This shows that BRI lending to energy projects fell 71% to $3.2 billion in 2019, the lowest lending by the two banks since 2008 (well before BRI launched) and compares to an aggregate to the sector under BRI of $183.4 billion (hover over individual countries for details, definitions of BRI are elastic). In fact, only three deals were signed in 2019, namely ChEXIM’s projects at Gurara in Nigeria and Koukoutamba in Guinea, both hydro; and China Development Bank’s Hunutlu coal fired power plant in Turkey.

Is this the end for BRI and especially coal fired power projects, seeing as China is practically the only source of finance for these nowadays (see my opinion piece on 28 Jan 20)?

Well, not so fast. This cat is not yet remotely dead and it will be able to bounce.

Power generation has long been the easiest sector to contract and thus the earliest sector to raise finance but BRI encompasses pretty much all infrastructure sectors (and beyond), not just power. Consider:

China to some extent paused BRI lending last year so as to hopefully put deals onto a more sustainable basis – see my opinion piece on 3 May 19.

BRI is now enshrined in Xi Jinping thought – see my opinion piece for the HKIoD on 2 Aug 18 – and, assuming (as I do) that the mandate from Heaven is not withdrawn, XJT including BRI will not go away any time soon.

At the same time, host governments and private sector sponsors also paused and alternative funding is available from Japan as ever, just recently the US, and local banks each in their own backyard. Further, China has more immediate issues on its plate, of course, such as the WuFlu / COVID-19, Taiwan, Hong Kong, Xinjiang, you name it – so expect low numbers in 2020 too but a recovery back towards significant influence after that.