When you have funded $440 billion of investment in six years, you can indulge in a little self – congratulation. But at last week’s Belt & Road Forum convened to maintain / regain the momentum of the Belt & Road Initiative (BRI), President Xi Jin Ping acknowledged a need to address i) sustainability (i.e. viability of the projects which are being financed by BRI) ii) transparency (of lending terms in the hope that others will join in) iii) zero tolerance of corruption. Foreign Minister Wang Yi duly promised progress reports on individual projects and Finance Minister Liu Kun offered a framework for assessing borrowers’ ability to repay. All on point.

Reaction from other countries in the build up to the forum had been varied. Italy, desperate for FDI, had signed an MOU but where is the harm in that? The rest of the EU was cautious, concerned about poor environmental standards of BRI and the fact that it represents competition. California sent its Lieutenant Governor, keen on a green agenda, but the US federal government sent no one, an attitude as churlish as its stepping out of the Paris Agreement on Climate Change. Last year, the US announced an infrastructure development programme for Indo–Pacific worth – wait for it – $113 million … not worth getting out of bed for as the lovely Linda Evangelista might say. More helpfully, a recapitalised OPIC (current Indo-Pacific exposure $4 billion, i.e. 1% of China’s) has just refreshed MOUs with Japan / Australia and with Canada / the EU 27. But good intentions do not equate to an open cheque book.

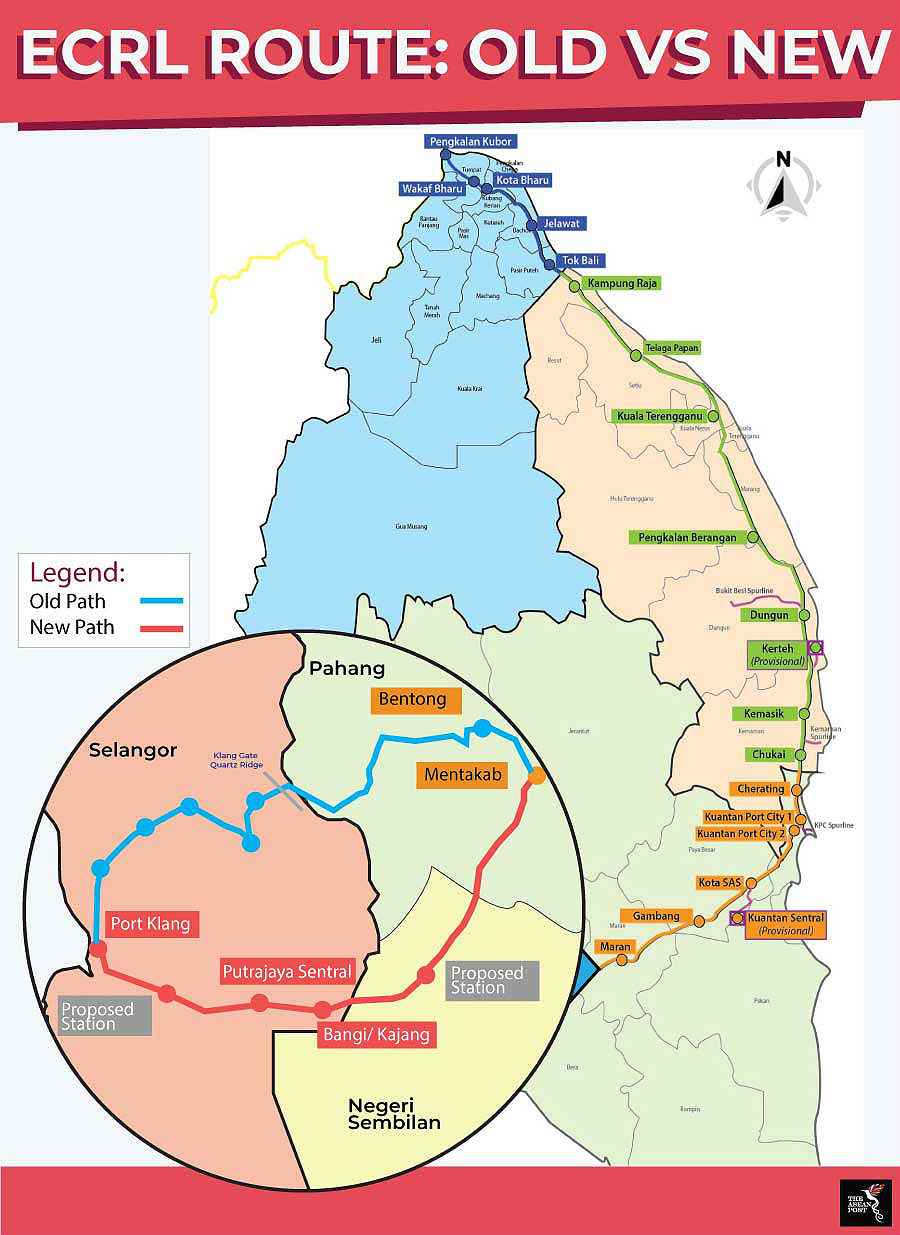

As I wrote for the HK Institute of Directors last year, 2018 was spent largely revisiting the irrational exuberance of early BRI deals. One example of this is Malaysia’s East Coast Rail Link (ECRL) which was renegotiated onto what appear to be more sensible terms just in time for the forum.

The new cost of China Communications Construction Co (CCCC) building the ECRL for Malaysia Rail Link (the project company owned

So how did China come to give up some $5 billion of value? No doubt, as any lender would, Beijing reasoned that a good smaller deal was more attractive than a bad larger one. Despite the US peddling the notion that BRI is aimed at “debt trap diplomacy” and citing the handover by Sri Lanka of the empty Hambantota port as an example of this, Hambantota is, in fact, the only such example. Thus did the US-based Centre for Global Development conclude when reviewing 80 projects where China had granted debt relief between 2000 – 17; as did Johns Hopkins University in examining 3,000 China – financed projects. In fact, China usually does what the Paris Club of creditor nations does, namely forgive and extend terms. A Chinese company will now own half the operator of the ECRL but that won’t earn much; more significant, if local allegations are true (they are denied by Malaysia’s Finance Minister), would be the 4,500 acres (1,820 hectares) of land along the route handed over to CCCC as part of the renegotiation. Certainly, developing land made accessible by a transport link is a valid means of capturing more value from Transit – Oriented – Developments, as HK’s MTR and Singapore’s MRT rail companies can attest. The economics of the project being financed will have changed with the new route and we still know little of these. But if the project is now sustainable (for which read “sensible”), it looks much more likely to endure. And if nothing else, Malaysia avoided paying the $5 billion cancellation fee.

So having talked the right talk at the forum, will China and its other debtors now follow the example of the ECRL and walk the right walk on BRI? Watch this space for the next twenty years.