On Wednesday, Andrew moderated the panel for the final of seven webinars in Enlit’s series on Indonesia’s New Energy Paradigm, i.e. the power sector and PLN. Fittingly, the series concluded with how to finance upcoming investment and how to turn potential opportunities into actual ones. He was joined by Pak Hot Bakara, EVP Corporate Planning […]

Refinitiv webinar on global infrastructure trends in a post – Covid world

Andrew joined James Cameron of StanChart, Mike Collins of the UK High Commission in Singapore and Mark Rathbone of PWC in a timely discussion today hosted by Rod Morrison of Project Finance International magazine around Refinitiv’s latest data for infrastructure finance raised. To listen to the recording, go here. Of the many points arising: Post […]

On the future of car parks in Hong Kong

Andrew commented ahead of Transit Jam’s 2020 Forum “Rethinking Vehicles First” in HK on 17 September that, at some point in the future, the role of the car will have been transformed from private ownership where the car spends most of its time sitting unused in a car park – to a service from the […]

The UK Treasury is drawing up plans to launch an investment bank

Commenting on a report in the Financial Times, Andrew pointed out that, even armed with GBP100 billion, a public sector investment bank cannot fund everything itself so needs to catalyse the private sector. First, this requires Properly Preparing Projects (the “other PPP”) which the private sector tends to take more care over. Second, the govt […]

Japan vows to slash financing of coal power in developing world

Commenting on a report in the Financial Times, Andrew pointed out that after Indramayu in Indonesia, Vung Ang 2 in Vietnam and Matarbari 2 in Bangladesh which are already in planning, sponsors will have only one place to go … China (Koizumi jnr is pictured).

Bangkok’s third airport: how to raise the funds?

Amidst the enormous uncertainty – both short and long term – now facing the aviation industry comes welcome news of heroes – or at least of heroic thinking. Last month, the BBS joint venture of Bangkok Airways, BTS Group and Sino – Thai Engineering signed a PPP contract with the government’s Eastern Economic Corridor Office […]

The CPEC two: what do we know?

We commented last week on Refinitiv’s latest report on aggregate numbers for China’s Belt & Road Initiative. Now comes news from Islamabad that a Prime Ministerial committee has accused two IPPs built and financed under the China Pakistan Economic Corridor of overcharging for power sold to the state. The committee considers that set-up costs of […]

The Belt and Road Initiative at June 2020

A shout out to Refinitiv and the fourth edition of their BRI Connect: An Initiative in Numbers report released this month. Our thoughts thereon: Refinitiv calculate that there are now 1,590 BRI projects (i.e. an MOU or a joint statement of cooperation has been signed between China and the host country; the map shows which) […]

Hong Kong water taxis – barely a sniff of the potential

Finally, one of the World’s greatest harbours is to get a water taxi service. Except that it isn’t. According to plans submitted by the Transport Dept to LegCo this week, State-owned Chu Kong Shipping was awarded a contract last month to start the service next month. (Chu Kong has also just agreed to buy 60% […]

UK Chancellor can still listen to Basil’s advice on Fawlty CBILS

Continuing Logie Group’s programme of collaborating with fellow experts, we recently teamed up with John Cleese’s character from the iconic 1970s sitcom to suggest how to sort out his wife Sybil. He saw this as a first. The government’s Coronavirus Business Interruption Loans Scheme promises loans of up to GBP5 million to SMEs from its […]

Stonehenge: what price a view?

All infrastructure investing involves balancing costs with benefits, some of which are hugely subjective – is an hour saved by not sitting in a traffic jam worth an hour at work or an hour at leisure? Why are these often valued differently? Does the fact that the UK has built more infrastructure in the south […]

How will the virus change investing in infrastructure?

When life returns to normal, it will be a new normal. Whilst waiting patiently for that new normal to arrive, Logie Group has collaborated with Mystic Meg to predict how infrastructure finance will have been permanently changed by the World’s response to the Covid 19 virus. If we’re right, you heard it here first. If […]

Not the WuFlu: is there comfort in infrastructure? A salutory tale

And now for something completely different … Relationship banking, name lending, call it what you will, “lifts the corporate veil” which draws a legal distinction between a company and its owners in that banks place some reliance on whoever owns or controls the borrower. More generous terms are perhaps extended, margins reduced or the loan […]

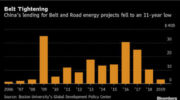

Belt & Road energy lending has fallen off a cliff: will it bounce back?

Bloomberg reports data from Boston University’s Global Development Policy Centre which tracks lending by China’s two main policy banks. This shows that BRI lending to energy projects fell 71% to $3.2 billion in 2019, the lowest lending by the two banks since 2008 (well before BRI launched) and compares to an aggregate to the sector […]

A graphic history of carbon dioxide emissions from coal in 53 seconds

This from Visual Capitalist’s plotting of every coal power plant in the World 1927 – 2019, ten lines of script down. It underlines how Global CO2 emissions from coal took off in the early noughties Mainly as China and India invested Whilst European sponsors and lenders have since moved to renewables The US eastern seaboard […]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 10

- Next Page »