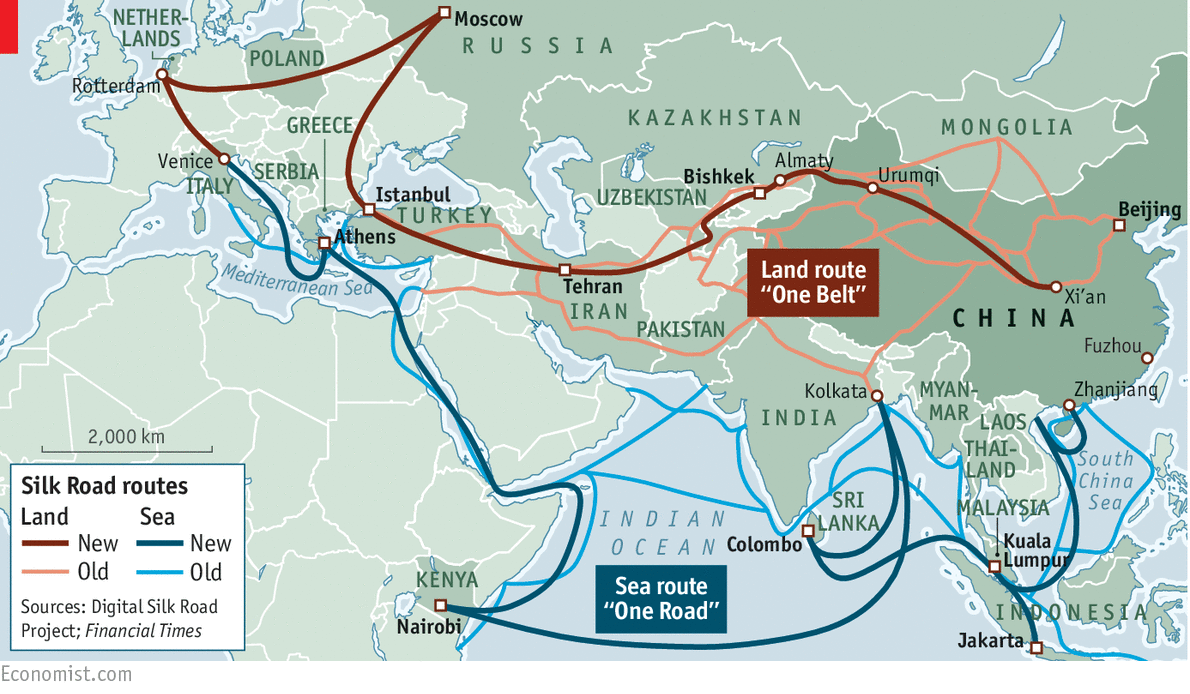

This is the third in a series of policy proposals focused on HK’s infrastructure and how to finance it. It comes as President Xi Jin Ping hosts a high level conference in Beijing this weekend on his massive Belt and Road Initiative (BRI) also known as the One Belt One Road (OBOR), One Belt and Road and various other permutations. The plan is to finance infrastructure along routes through Asia to Europe and even Africa, both overland (the Belt) and maritime (the Road). 65 countries are hoping for perhaps $30 trillion (that’s with a T; make up your own number in front of it) of investment over the next fifteen years or so, so as the lovely Linda Evangelista might say, this is worth getting out of bed for.

This advice differs from my other pieces in that the infrastructure in question will not be in HK; and in that my advice goes out not to Carrie Lam Cheng Yuet-ngor who takes over as HK’s Chief Executive in seven weeks but who, curiously, is not invited to the conference. Instead, it goes out to the incumbent Leung Chun-ying (“CY”) who has taken to impending retirement like a (lame) duck to water on almost every issue except this one.

In promising unbelievable amounts of money to pretty much half the world, BRI could make the US’s Marshall Plan to reconstruct Europe after WW2 look like a petty cash disbursement; it is being championed by the President himself and promoted far and wide. This promotion even extends, in what can only be ascribed to very long term planning, to China Daily launching a series of bed time stories to explain the concept to English speaking children (I am not making this up). All are supportive: the United Nations hosted a conference in HK this week on how Public Private Partnerships (PPPs) could best contribute to meeting its Sustainable Development Goals with particular reference to BRI. So there is no doubting the ambition. But what will this feeding trough look like? And how can HK get at it?

China has already committed serious money to, for example, the $54 billion China Pakistan Economic Corridor which will link China’s far west to the Indian Ocean at Gwadar but the objectives of BRI have not been spelled out. We can, however, work on the basis that BRI is designed to put excess capacity in China’s State Owned Enterprises to work, extend China’s influence over its near abroad and not-so-near abroad and go some way to recreating the Middle Kingdom’s tribute system. If vassal states get to build some much needed infrastructure, that is a bargain that most will consider worth striking.

Delegates are calling for a list of BRI – compliant projects. This will include almost everything so will not mean much unless it is broken down into shovel – ready projects and those on the way to being shovel – ready. As Indonesia’s Blue Book has shown in the past, though, lists of projects need to have some substance to them. But getting infrastructure projects shovel – ready is hard work which Trump will also find out in the US as I have previously pointed out. It requires host governments to have established reasonable regulatory and legal environments; to have designed the context of the asset (the position of a power plant on the grid, onward connections at either end of a road, etc.); to have sized the asset; to have worked out the logistics such as access to cooling water for a power plant; to have gauged external costs and benefits such as the scope for real estate development along a rail line; and to have at least explored how risk could realistically be shared, what government support might be needed and more. This Proper Project Preparation (the other PPP) is necessary even if the finance comes on a sovereign basis, as much of BRI surely will. It involves making decisions beyond most government personnel pay grades on high value, long dated and politically sensitive matters and many host governments will need a helping hand. (Logie Group stands ready to give such advice and at very reasonable fees). So the first question is: will BRI i) fund such advice ii) wait for the projects to come forward and only then invest or lend iii) plough the money into projects which have not been properly prepared?

Second, much of this infrastructure is to be built in countries which carry huge political as well as commercial risk. Will BRI shoulder such risks and dare to tread where more established multilateral and bilateral agencies have not? In order of decreasing appetite to take such risks, the funds will come from China’s $40 billion Silk Road Fund and some of its thirteen regionally focussed funds together worth $100 billion +; China’s policy banks namely China EXIM and China Development Bank which together have already lent worldwide more than the World Bank group; China’s state – owned commercial banks such as ICBC; the China – sponsored New Development Bank (the BRICS development bank) and the Asian Infrastructure Investment Bank which will behave more like their more established peers such as the World Bank, ADB and EBRD; local state – owned banks in the country concerned; some third – country export credit agencies but not JBIC (Japan), KEXIM (Korea) or USEXIM; and private sector capital markets, lenders and investors who come last on the list in that they will take almost none of the political risk in particular.

Involvement of the private sector will be trumpeted but it will come by lending to China Development Bank, for example, not to a rail line across Uzbekistan. Yi Gang, Vice – governor of the People’s Bank of China, will no doubt have realised this when he opined this week that support from the “global market was desperately needed”. However, I fear that Wang Huiyao, Director of the think tank Centre for China and Globalisation, was being overly optimistic when he appealed to Sovereign Wealth Funds from the Middle East and south East Asian tycoons to join in. Fat (cat) chance of that!

This, then, is a tremendously ambitious programme, out of which in due course and not without difficulties along the way, will come great benefit to many millions. If the western world and particularly past and current administrations in the US fear that it will change the geopolitical landscape across Asia (which it will), they have only themselves to blame by denying China greater influence at the Bretton Woods institutions such as the World Bank and IMF and by not doing more in these countries whilst they had the field to themselves.

What of HK’s role in all of this? CY is leading HK’s delegation to the conference aiming to promote HK as a super connector for BRI. No, I don’t know what that means either but I suggest that he lobby on behalf of the business community here and point out its competitive advantages which are several.

(The SFC is proposing to ease listing rules for IPOs on the HK stock exchange of BRI – linked issuers (howsoever defined) so as to compete with Shanghai and Shenzhen. This may make it easier to raise money (and perhaps lose it) but, by itself, will not fundamentally change the risk profile which those investors face.)

HK’s private sector investors, capital markets and lenders will take a look but need the opportunities to be sensibly structured such that they take only risks which they can control or can at least take a view on. This is a big ask.

HK’s banks will be looking at much safer processing business such as handling RMB convertibility, not to be confused with management of foreign exchange risk which, like everything else with BRI opportunities, will be enormous.

HK’s bilingual services community has much to contribute. Lawyers will be needed to not just design the legal and regulatory frameworks and draft project contracts and financing documents but also to resolve disputes, of which there will be many. HK’s technical services will be needed in project preparation and subsequent management. And its financial skills will be required, not just in crafting sensible risk allocation but also in designing government support – where and when this is necessary to enable a financing to happen, how to structure that support, ration it, recycle it and more (Again, this is what Logie Group does).

As a means of delivering infrastructure, BRI is still taking baby steps albeit enormous ones. Yes, the HK business community can facilitate these steps. Over to you, CY.