Andrew acts as an expert witness in arbitrations and other distressed situations. He can also review loan books and lead work outs.

In 2017 – 8, he submitted two opinions in support of a Canadian investor which had taken the government of a CIS country to arbitration concerning its investment in a gold mine in that country. The case is still pending.

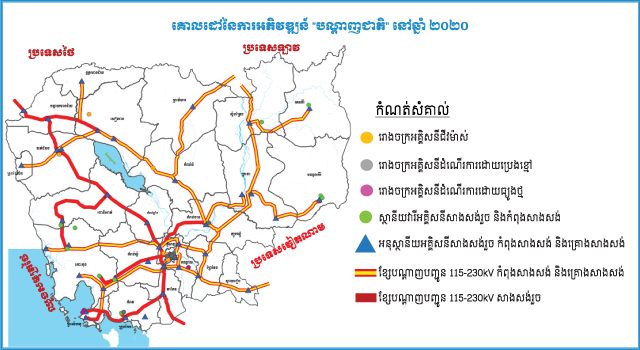

In 2012, Andrew acted as an expert witness in financing for Beacon Hill Associates in their $125 million ICSID arbitration against the Cambodian government re Cambodia Power Co, a 67 MW Independent Power Project to be built in Phnom Penh. Funded by a third party funder, he submitted a 16,000 word opinion as to the roles played by the Ministry of Economy & Finance and by Electricite du Cambodge in why the developer was ultimately unable to raise finance for the project; and at the tribunal in Paris, he was cross examined in person on his opinion and participated with the other financing expert in a “hot tub” exchange of views (both rare and challenging experiences for an expert witness). The value of the hot tub lay not just in the exchanges but also in the preceding negotiations to slim down the agenda to only key commercial issues, thus giving the tribunal greater focus. In 2013, the tribunal found in favour of the government.

In 2004 – 5, Andrew acted as an expert witness in financing for Fraport, operator of Frankfurt airport, in its $600 million ICSID arbitration against the Philippines government re ownership of Manila airport terminal 3. He submitted four opinions totaling 20,000+ words. He examined how the concession was originally let then how it was subsequently amended. He compared its terms to both other infrastructure financed in the Philippines and to other airport terminals elsewhere, concluding that the project contracts delivered a reasonable allocation of risk and that the terms of the third party financing were also reasonable. He exchanged views with first one, then a replacement, expert on the other side and was due to testify in person when the other side conceded on his views. This dispute remains one of the longest running and highest profile disputes in the region. The tribunal found against Fraport in 2007 and again in 2014 after the original decision was annulled and the case resubmitted. There was a separate arbitration between the project company PIATCO v the Philippines under ICC rules in Singapore which also failed. However, in 2016, Fraport received compensation of $270 million through local regulations.

In times of stress, the quality of banks’ loan books needs to be revisited. This is an exercise which is time consuming yet needs to be rigorous, independent and consistent. Andrew offers unusually broad experience in sophisticated risk evaluation, experience gained at advisor and Lead Arranger level where issues are both identified and solved. This has been in:

- both developed and emerging markets;

- most structured / project / export finance sectors, i.e. energy = conventional and renewable power generation, transmission and distribution, oil and gas and petrochemicals; telecoms = fixed, mobile and cable networks; infrastructure = roads, rail, water, ports, airports, logistics and hotels; metals and mining;

- equity and debt for aircraft leasing;

- leveraged finance, i.e. LBO / MBO in various industries.

At WestLB, he had responsibility for a loan book of €2.5 billion and in his time his teams looked at practically every such deal in the region.

Andrew is able to lead work outs. This requires running / organising / influencing a negotiation process, one which is contentious and time consuming and which requires consensus / compromise in changed circumstances. He personally led the workout of an early hotel deal in Australia; and supervised the renegotiation of various legacy loans inherited from the Asian crisis of 1997 – 98 leading to the eventual writing back of all provisions and many lessons learned. He also brings to bear his experience as an expert witness on complex arbitrations.

As an independent advisor, he is less likely to have conflicts of interest with parties involved in such cases.