Andrew brings 2

2003 to 2009 and 2011 to date: Hong Kong – Managing Director of Logie Group Limited

Andrew is currently bidding in separate consortia for several Technical Advisory mandates to advise the governments of Indonesia and the Philippines.

In 2017 – 8, he submitted two opinions in support of a Canadian investor which had taken the government of a CIS country to arbitration concerning its investment in a gold mine in that country. The case is still pending.

In 2016, he worked with a leading management consultancy to raise up to $7 billion of funds to build a new capital city for a recently bifurcated state in India.

In 2013 – 14, Andrew advised on the sale by a U.S. developer of a $30 million portfolio of run – of – river hydro schemes in Sri Lanka. He approached potential purchasers and prepared investment memoranda. The business was eventually sold to a third party.

In 2012 – 13, Andrew advised an Australian superannuation fund on how to diversify into Asian infrastructure. There are comparatively few investment opportunities in the region which have achieved Financial Close, been constructed and proved up the revenue line via two to three years of operations. Competition to buy into these is correspondingly higher, prices higher and returns lower to passive investors when they are unable to enhance their yield by also building, supplying or operating the asset as trade investors do. However, diversification and attractive yields can be found by careful selection and mitigation of early revenue, construction and even development risk. Choice of project and partners is, as always, key.

In 2012, Andrew acted as an expert witness in financing for Beacon Hill Associates in their $125 million ICSID arbitration against the Cambodian government re Cambodia Power Co, a 67 MW Independent Power Project to be built in Phnom Penh. He submitted a 16,000 word opinion as to the roles played by the Ministry of Economy & Finance and Electricite du Cambodge in why the developer was ultimately unable to raise finance for the project; and at the tribunal in Paris, he was cross examined in person on his opinion and participated with the other financing expert in a “hot tub” exchange of views. In 2013, the tribunal found in favour of the government.

In 2010, he took time out from Logie Group to act as Head of Public Private Partnerships Advisory Services at the Asian Development Bank (see below) before returning to Logie Group.

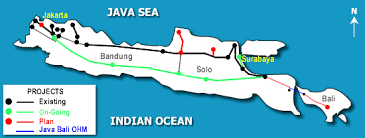

In 2009 – 10, Andrew acted in joint venture with a Singapore – based financial advisory boutique, an Australian legal practice and a global engineering firm to advise Bappenas, the planning ministry, and the Ministry of Public Works on a $235 million fresh water pipeline project in Indonesia. Issues included what risks could sensibly be transferred to the private sector, how the central government should best support obligations of the province and municipalities’ water distribution companies as offtakers to the project and how to effect structural change in the water companies so as to render them less needy of such support in the future.

In 2006 – 7, Andrew advised the Indonesian MOF on various infrastructure plans which called for an ambitious $15 billion to be invested over the next several years. These included $10 billion to be spent on 10GW of coal fired power plant to be built for PLN (the state owned electricity utility) under its first Fast Track programme where PLN’s obligations under EPC contracts were guaranteed by the MOF; and up to $3 billion of capacity to be provided by IPPs supported by a Memorandum of Mutual Understanding with JBIC for Japanese – sponsored projects. (As it is, the MOF supports all of PLN’s business via the Public Service Obligation (PSO) subsidy.) He also scrutinised various transport projects. The Indonesian Infrastructure Guarantee Facility (IIGF), the Indonesian Infrastructure Finance Facility (IIFF) and a Risk Management Unit (RMU) in the MOF were also established. Thus, Indonesia was experimenting with various methods of government support, all of which began to be developed when Andrew was there. His role was to assess the nature and extent of government support for each such project and advise on the suitability of the terms and conditions proposed for each financing. This included consideration of how much risk should be transferred to the private sector and whether the government was prepared to pay for this. On the power programmes alone, issues included fuel supply arrangements, fuel mix policy, equipment procurement mechanisms, cost of the the PSO subsidy, assessment of value for money and how best to sell the story of Indonesia’s new found pragmatism to an investor and financier community which was still cautious on its ability to deliver such projects on a sustainable basis.

In 2005 – 6, Andrew acted as interim CEO for a company looking to raise $40 million for investment in projects to reduce greenhouse gas emissions and thus earn carbon credits under the U.N.’s Kyoto protocol. Priority technologies were methane from landfill and PFCs from aluminium smelters. Target countries were China, the Philippines, Malaysia and Thailand. He stepped down from this business in Feb 06.

In 2004 – 5, Andrew acted as an expert witness in financing for Fraport, operator of Frankfurt airport, in its $600 million ICSID arbitration against the Philippines government re ownership of Manila airport terminal 3. He submitted four opinions totaling 20,000+ words. He examined how the concession was originally let then how it was subsequently amended. He compared its terms to both other infrastructure financed in the Philippines and to other airport terminals elsewhere. He exchanged views with first one, then a replacement, expert on the other side and was due to testify in person when the other side conceded on his views. The panel found against Fraport in 2007 and again in 2014 after the original decision was annulled and the case resubmitted. In 2016, Fraport eventually received compensation of $270 million through local regulations.

Andrew writes and presents public and in – house training programmes on project and infrastructure finance in Asia and, more recently, Africa. The courses are distinguished by being heavily rooted in case studies, drawing on current market practice and Andrew’s many years of practical experience in Asia, Europe and Australia.

Since 2007, he has worked with BG Consulting, Clarion Training, Euromoney Learning Solutions, Quest on the Frontier, the Taiwan Academy of Banking & Finance, UNI Strategic and (at three levels of experience in conjunction with a leading law firm) the ADB.

2010: Manila – Head of Public Private Partnerships Advisory (PPPA) Services at Asian Development Bank

Andrew set up the PPPA team at the Asian Development Bank to boost the bank’s lending and investing into not just PPPs, defined as all infrastructure including power, but also public non – sovereign lending to State Owned Enterprises, municipalities, etc covering the bank’s full geographical remit from the South Pacific to the ‘Stans.

As such, he advised a number of Developing Member Country governments on how to set up an appropriate enabling environment in terms of relevant legislation and regulation; on the choices for government support for industry sectors and individual projects; on selection of pathfinder projects in each sector; and on likely financing appetite from domestic and offshore investors and lenders. He advised the ADB on what measures it should include in its terms and conditions when lending to governments so as to promote development of infrastructure featuring private sector participation. And he co – authored the bank’s business plan for promoting its PPP business across all infrastructure sectors.

1998 – 2002: Hong Kong – Managing Director and Head of Structured Finance, Asia Pacific at WestLB

Structured Finance consisted of Lead Arranging a wide variety of value – added lending including project finance, export finance, corporate finance and leasing in the fields of

- energy including power, oil and gas and petrochemicals;

- fixed line, mobile and submarine cable telecoms;

- infrastructure including ports, water, airports, hotels, road, rail and logistics;

- metals and mining;

- aircraft leasing;

- leveraged finance, i.e. LBO / MBO in various industries for private equity houses and listed companies.

In its largest market sector, project finance, the bank consistently ranked in the top 5 globally by volume of deals arranged.

Andrew ran both the region and the Hong Kong team within the region. Teams in Sydney and Tokyo, plus a representative in Mumbai, reported into him.

Despite at times difficult markets, he reorganised the business and grew it from a headcount of 22 to 30. From 1998, SF Asia Pacific annual revenues grew at 21% compounded annual growth rate (“CAGR”), ultimately exceeding €30 mio. Similarly, result before tax grew at 17% CAGR, ultimately exceeding €18 million and beating budget in every year. The loan book exceeded (a clean) €2.5 billion.

He achieved this by focusing the teams on Lead Arranger roles and on Deals of the Year (e.g. Shell / CNOOC’s petrochemicals plant in Nanhai, China; Tradeport and Asia Container Terminals in HK, Manila North Tollroad in the Philippines, Yallourn Power in Australia); pioneering markets such as the Japanese Operating Lease (e.g. Scandinavian Airlines and Air N.Z.) where the team also sourced equity; and introducing new business lines such as leveraged finance.

Raising of credit standards was key: he approved all credit applications in the region and spent perhaps 20% of his time on these. He also committed resources to workouts such that provisions were able to be subsequently released.

He overhauled marketing and management information flows. He also introduced various HR initiatives such as technical and skills training as well as short and long term secondments for fast track personnel.

He was instrumental in purchasing a significant stake in the only Asia – based aircraft lessor, Singapore Aircraft Leasing Enterprise (now BOC Aviation Limited), and acted as an Alternate Director on its board. This business duly delivered the synergies envisaged between it and the bank; grew substantially both in scale and earnings; and justified the purchase decision. It was subsequently sold in 2006 to Bank of China at a considerable profit.

Inter alia, he set strategy; led the marketing / execution; approved all credit submissions; and approved new hires / remuneration. He reported to the Global Head of Structured Finance; and sat on the global Structured Finance management committee as well as the bank – wide Asia Pacific regional management committee.

1990 – 1998: London – Project Finance IBJ / Mizuho Group and UBS

From 1994 – 98, he was deputy head of the project finance team for UBS covering all sectors. From 1990 – 94, he had responsibility for the energy and infrastructure (including Public Private Partnership) project finance businesses at IBJ (now Mizuho Group). Both banks were significant players at this time and he led various Deals of the Year for each. Power plants included Barking, Keadby, Teesside and NIGen in the U.K. and api Energia in Italy. Mines included Rio Tinto’s Lihir Gold in Papua New Guinea, now owned by Newcrest Mining Limited.

1987 – 1990: Sydney – Project and Structured Finance Advisory at Westpac

Andrew set up the new product development team which coordinated bank – wide initiatives on target customers via brainstorming sessions; and which acted as a disciplinary function for all new products being marketed by the group. He also developed / ran a variety of tax efficient structures.

1978 – 1987: London / HK / Sydney – Accounting Firms KPMG and PWC

Andrew qualified with KPMG in London then moved first with them to HK and then onto PWC in Sydney. Clients included BAe Systems and Pinewood film studios in the U.K.; CLP and Hongkong Land in Hong Kong; and Wyndham Estate Wines in Australia.

Qualifications and aptitudes

Andrew has an honours degree in Economics and Accounting from the University of Bristol (1978) in the UK, specialising in urban economics and tax policy.

He has spoken at numerous engagements around the world and is regularly published in the specialist press as well as in the Financial Times, South China Morning Post, the Hong Kong Standard, Cathay Pacific’s Discovery in-flight magazine, HKICPA’s A+ magazine and more.

Separate psychological profiling and IQ tests place him in the top 1% of the population / top 5% of management in terms of critical thinking ability and he is a member of MENSA.

From 2013 – 8, he was an advisory board member of the Centre for English and Additional Languages at Lingnan University.

He was Honorary Treasurer of the Ladies Recreation Club, a 3,000 member sports club in 2014 – 5; and is Treasurer of the Incorporated Owners committee of a building which has recently undergone a complete renovation.

He is married and has dual British and Australian nationality. He and his wife have traveled extensively in Asia, Australasia, Europe, the Middle East and North and South America.