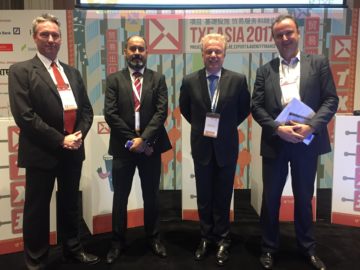

Andrew moderated the session on Access to Infrastructure Finance at the TXF Asia conference in Hong Kong on 11 – 12 October. He was joined by Pranav Chandna, Director of Global Project Development & Structured Finance at Philips Capital in India; Allard Nooy, CEO of InfraCo Asia; and Frederic Pergay, VP Business Development for Asia Pacific at Bouygues Construction.

The funds are available for Properly Prepared Projects, from not just banks but also DFI – funded developers, contractors able to also invest, the leasing market and now the Belt & Road Initiative. Non – power infrastructure, i.e. everything from transport to water, waste management, health and PPP, are similar in that they typically have unpredictable or volatile revenues; those revenues are mostly in local currency; and it can be politically difficult to ever exercise security. But they differ markedly in the degree to which they are a natural monopoly or face naked competition; whether they need government support or can contribute to its coffers; and the scope for ancillary revenues such as capture of the increases in real estate value created by the project.

Ultimately, of course, a successful deal is not just one which gets signed; it is one whose terms have foreseen all possible changes of circumstances and counterparties a long way into the future such that, be it sovereign, corporate, name, structured or project financed, a useful asset comes into being and the investment gets repaid!