The latest news on Manila airport is that the San Miguel – led consortium, SMC – SAP, has won the bid to redevelop Ninoy Aquino International Airport on a PPP basis. Other members of the consortium are the less well – known RMM Asian Logistics and RLW Aviation Development with airport expertise coming from Incheon. The Concession Agreement is expected to be signed next month. This is progress.

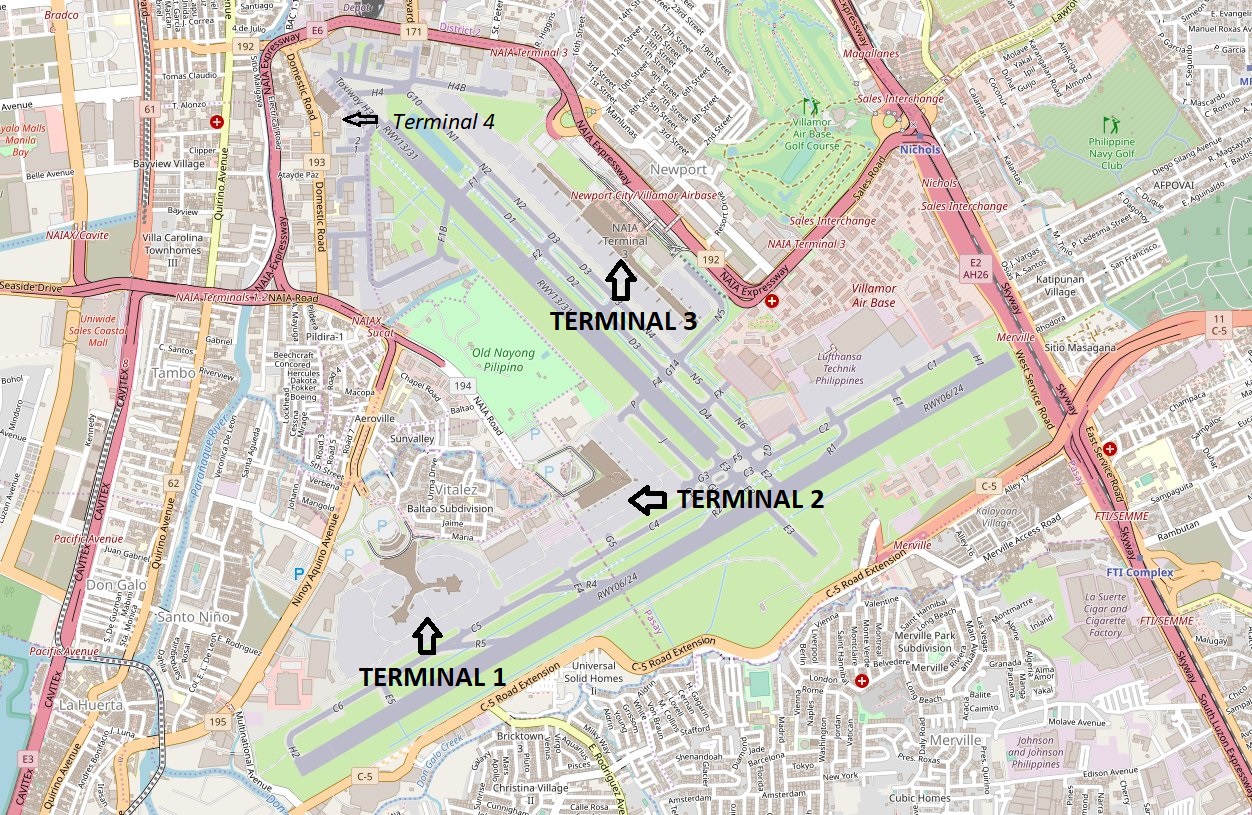

The project is to upgrade the three rather disconnected existing main terminals and build a fourth under a Rehabilitate, Operate, Expand and Transfer contract to run for 15 years with an option to extend for a further ten years. (There is, in fact, an existing tiny old terminal 4 for propeller craft). The concession carries a headline price tag of Ᵽ171 billion ($3.1 billion) (does this mean aggregate spend?) so as to increase capacity from 35 million pax p.a. (which is already above design capacity of 30 mppa but down from 48 mppa in the good ol’ days of 2019) over two phases to 62 mppa. (Airport capacities can be stretched depending on the time of day that aircraft use them, for example.)

Preliminary analysis of available info:

- Terms include paying the government Ᵽ30 billion ($545 million) upfront plus Ᵽ2 billion ($36 million) p.a. in annuity payments but the primary criterion for awarding the concession was the proportion of non – regulated, non – aeronautical revenues (i.e. everything except the passenger fees and probably landing charges) also payable to the government. San Mig offered a jaw dropping 82%. This is revenues, not profits of some sort, and comes on top of the upfront payment and the annuity. No wonder that Transport Undersecretary Timothy Batan crowed that the government expected to receive a cool Ᵽ900 billion ($16 billion) over the twenty five years. Take out opex and debt service and what does that leave for equity? True, duty – free shopping by returning Overseas Filipino Workers is significant but, after that, you are looking at revenue lines such as car parking. Can the $3 billion capex estimate be trimmed perhaps? This was calculated by the government for all bidders so can the required levels of service be delivered whilst investing less?

- There are, as ever, engineering challenges. The civilian side of the site had already taken over the military side from the Bases Conversion & Development Authority so there is little room for expansion. The existing fourth terminal will no doubt be bulldozed; lengthening the second runway has major implications for the neighbours; just as significantly, the terminals need to be better connected.

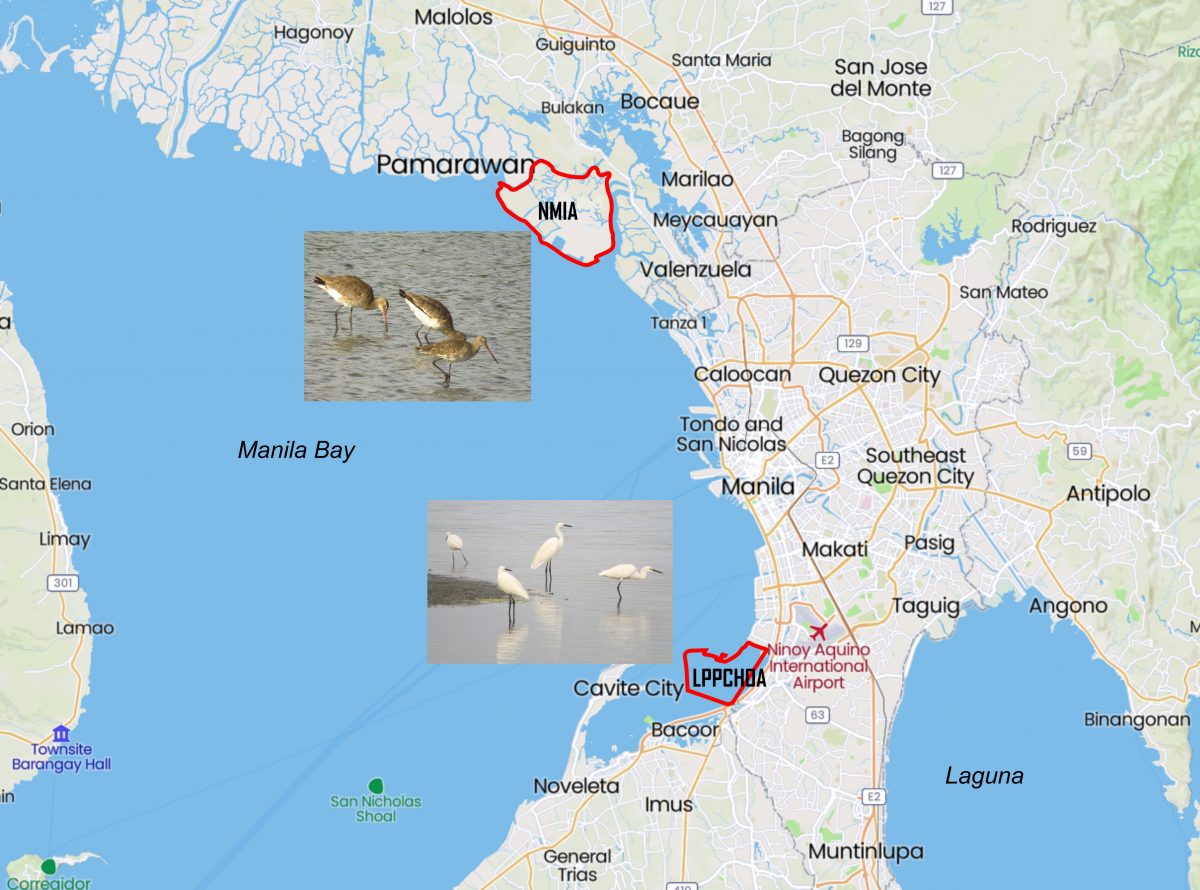

- Back in 2019, San Mig signed to build the New Manila International Airport (NMIA), an ambitious green field, four runway airport on 2,500 hectares in the wetlands of coastal Bulacan province that it had consolidated ahead of an unsolicited bid. Eventual design capacity was originally intended to be an implausible 200 mppa (!), since trimmed to 100 mppa. COD was originally scheduled for 2027 and land development, at least, is underway. But does the country need a combined capacity of 162 mppa that Bulacan and a revamped NAIA would represent? (By comparison, current capacity at Changi is 85 million mppa.) Even San Mig will struggle to raise funds for both. Or did the NAIA deal include consent from the government to downsize or even abort Bulacan?

NMIA has a lot more space - The Philippines has a long history of involving the private sector in sharing the risks and rewards of building and operating infrastructure – its first BOT Law dates back to 1990 and its PPP Centre was one of the first to be established in the region. However, during the administration of Benigno Aquino III (2010 – 16), only three modest projects were completed on a PPP basis. Rodrigo Duterte (“DU30”) (2016 – 22) was less patient and switched to sovereign debt, especially from China, plus unsolicited proposals under his Build Build Build programme but fared little better in that only 15 out of 119 planned projects were completed. A year and a half into the administration of “Bongbong” Marcos Jr. (“BBM”) (2022 – ) and his (another BBM …) Build Better More (than his predecessor?) programme, this project represents a bit of a comeback for PPP as a financing tool. He is doing something about it, though, by, for example, amending the Public Service Act to lift the 40% cap on foreign ownership of certain infrastructure sectors (such as airports) albeit not on others (such as water), a PPP Code and a revised BOT Law and its Implementing Rules & Regulations. With 197 projects in various states of readiness on the agenda, he will need all the private sector capital and public sector enabling, project preparation and decisiveness that he can get.

Almost as interesting were the losing bidders:

- Manila International Airport Consortium had offered a 26% revenue share. MIAC comprised almost all the remaining Great and the Good of Philippines business, namely … deep breath … Aboitiz; Ayala; Asia’s Emerging Dragon Corp i.e. John Gokongwei, Henry Sy, Sr., Lucio Tan, George Ty, and Alfonso Yuchengco whose unsolicited bid to build NAIA terminal 3 was trumped by the ill – fated PIATCo; the Gotianun family’s Filinvest; the Gokongwei group’s JG Summit; and particularly a deep – pocketed foreigner in the shape of Global Infra Partners looking to move up the risk spectrum. Last year, Andrew Tan’s Alliance Global joined, having taken full control from Genting of the Newport World Resort hotel / casino over the road from NAIA. Earlier iterations of the consortium had submitted a Ᵽ100 billion / US$1.8 billion unsolicited proposal pre – Covid, withdrawn it then last year submitted another headlined at Ᵽ267 billion / $4.8 billion. Not to mix metaphors but which of these Big Cheeses was to have corraled the others? But they assuredly would have had plenty of political influence.

- The GMR group had offered a 33% revenue share. Considered by some as the frontrunner because it was led by the Indian airport behemoth (not the Polish heavy metal one), the consortium also included the Yuchengcos’ House of Investments and fellow locals Cavitex.

- Perhaps unsurprisingly, Asian Airport Consortium had been eliminated earlier on technical grounds. That consortium comprised locals Asian Infrastructure and Management, Lucio Co’s Cosco Capital and logistics company Philippine Skylanders International with Indonesia’s SOE airport operator PT Angkasa Pura II.

What of the other two airports once being developed?

- Clark / LIPAD is 80 km to the north of Manila, too far for recognition by IATA but very useful for those wanting to go home to central and northern Luzon and avoid Manila. A new terminal there, owned by Filinvest et al and run by Changi, brought the design capacity up to a relatively modest 12 mppa in 2022.

- The project to expand Sangley Point in Cavite is much more centrally located. It too has had its stops and starts but the local province has not given up hope yet.

The saga that is Manila airport – or airports – has been running for coming up to 30 years. It includes scar tissue such as Fraport taking twelve years to get even some of its investment back from terminal 3. When looked at from the outside, the project economics of this latest iteration look questionable and a renegotiation of terms, publicly or privately, may at some point be needed. But this need not be unusual. Back in 2018, a study for the Global Infrastructure Hub found that fully 33% of PPP concessions were renegotiated at some point. Given the political influence of the private sector proponent and the profile of the nation’s capital airport (not to mention its potential to be more of a regional hub), the government might well be amenable to amending terms. Nor would a renegotiation necessarily be surprising when you consider how mightily difficult it is for anyone, expert or amateur, to predict human behaviour so far into the future.

Where expert advice is needed, though, is in the design of the risk sharing so that whichever outcome eventuates, all parties remain committed / incentivised / replaced to making a key piece of infra available to the country and its citizens. This is where Logie Group can contribute. Andrew acted as an expert witness for Fraport on its arbitration re NAIA terminal 3 – many lessons can be learned from deals which go wrong, hopefully at someone else’s expense – and he can do so again if this latest deal on Manila airport requires formal or informal fine tuning / wholesale renegotiation. Even wiser would be for either side to take his advice ahead of time on those 197 upcoming projects.