Congrats to the HK Trade Development Council on hosting this year’s Belt & Road summit ahead of next month’s Forum in Beijing. It is ten years to the month since President Xi Jinping launched what was to become the Belt and Road Initiative in a speech in Kazakhstan (which promptly appointed itself the “buckle” in Belt & Road).

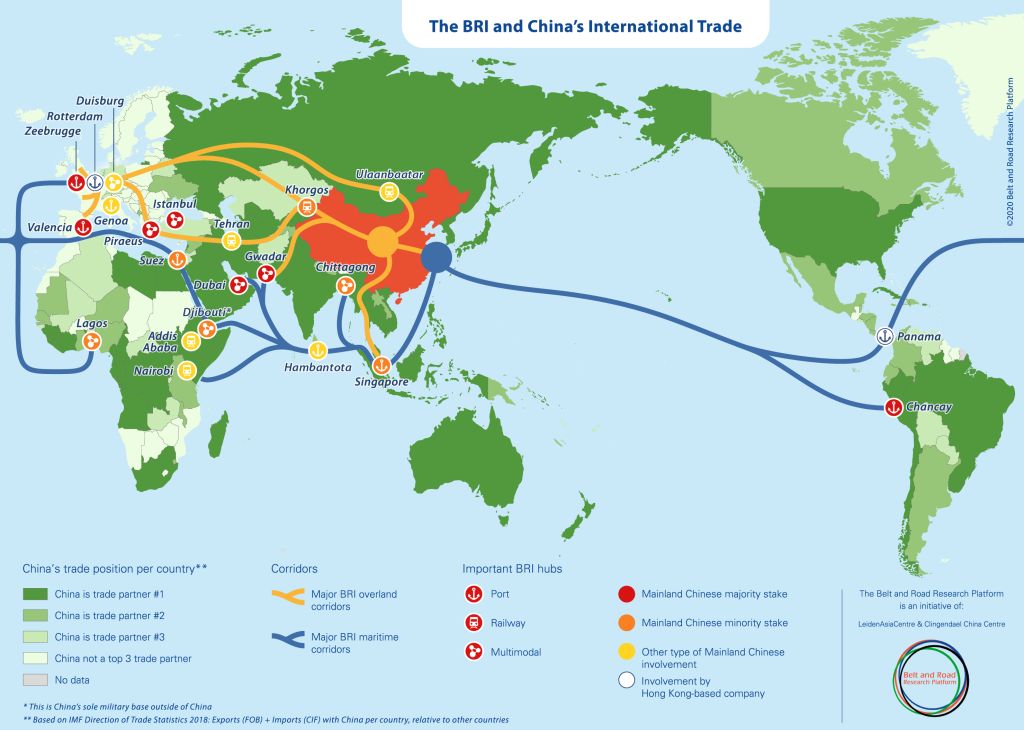

There have been success stories, sung and unsung, such as the transformation of the port of Piraeus, considered quite colourfully as the dragon head for BRI, but when you have deals which are complex, high value and already internally politically sensitive, deals where the external political imperative trumps economic reality, deals which are negotiated between the very large and the comparatively inexperienced, deals which are negotiated quickly and with little input advice from experts – you should not be surprised when so many go wrong – a problem for debtor and creditor alike. But lessons can be learned from deals gone wrong albeit at a cost, lessons which can then be applied to new deals.

As Oscar Wilde might have put it, reports of the death of BRI are greatly exaggerated. It is enshrined in the Communist party’s Constitution (albeit with no explanation of what it entails) alongside thirteen references to General Secretary Xi Jinping’s major policy addresses, his core position on the Party Central Committee and in the party as a whole and his Thought on Socialism with Chinese Characteristics for a New Era. As I have previously written, the heady days of (at least promising to) throw $60 billion at the likes of the China Pakistan Economic Corridor are long gone. Charges by the US that irrational exuberance like Hambantota port in Sri Lanka amounted to “debt trap diplomacy” have been dismissed. Thus, back in 2021, President Xi Jinping called for BRI deals to be more “small but beautiful”. Accordingly, BRI remains politically charged but it has evolved to become more economically sustainable. This makes it a little more likely that non – Chinese investors and lenders will join. Thus, when faced with competing offers, host governments should set Belt & Road funding from China up against the recently (slightly) loosened purse strings from the West.

Although HK has tended to avoid investing in or lending to most BRI deals, the deep pool of professional services here can deliver expert input to both the more promising new opportunities in the Middle East and elsewhere – and to sorting out earlier deals gone wrong. And yes, those professional services include Logie Group, both in advising host governments and sponsors on how best to structure new deals and in acting as an expert witness, formal or informal, in resolving disputes.