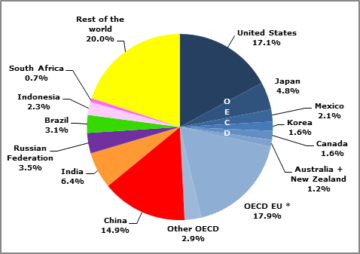

The OECD accounts for perhaps 50% of World GDP; take out its small, rich members and add in the six big, poorer BRIICS and you get the G20 which accounts for 73% of World GDP. Thus, when the two organisations come together to discuss long term investment, the potential agenda is enormous and every perspective is going to feature.

Andrew joined the workshop in Singapore on 30 January ahead of the meeting of the task force the next day.

The formal agenda, led by the G20’s Global Infrastructure Hub, focuses on where some consensus lies, namely i) an Infrastructure Data Initiative which looks to build benchmarks for projects in different sectors and countries, recognizing that host governments need to choose between sectors and that private sector investors have a choice of not just sectors but of countries too ii) recognition that new technology (and perhaps blockchain) will fundamentally change how infrastructure assets perform (on which see Andrew’s opinion last November).

The informal agenda is much bigger. Just three examples:

How should the rest of the World respond to China’s Belt and Road Initiative? As Andrew has written previously, BRI is, at one level, just another Export Credit Agency albeit one which does not comply with OECD rules and which adds a couple of zeros to the sums involved. World Bank President – presumptive David Malpass is not alone in being wary of BRI but he should use his new role to, in fact encourage BRI on condition that its Projects are Properly Prepared (the “other” PPP), recognizing that China has brought more people (mostly its own) out of extreme poverty these past forty years than any country on Earth. If BRI lending terms are transparent and international Environmental, Social and Governance standards are complied with, the hope is that Mr. Malpass’ IFC and other Bretton Woods institutions can crowd in commercial banks from outside China because not even Beijing can do it alone.

That Proper Project Preparation, i.e. design, sizing and economic justification, is, of course, mostly the responsibility of the respective host governments. It is they who are tasked with the most difficult steps in the process (How to place a value on less congestion or fresh air? How to acquire land at sensible cost in a sensible time frame then clear it humanely? Etc.) yet they are often the players with the least experience (and remuneration). Pioneers of private sector participation from the G20 such as the UK, Canada or Australia have much practical experience to share; all members of the OECD should help pay for this advice – which Logie Group stands ready to provide.

Infrastructure, of course, contributes to what we still euphemistically call climate change. If the rich outside World wants Indonesia, to pick just one example, to not burn its cheap, local brown coal, will it pay? That’s a whole other agenda.