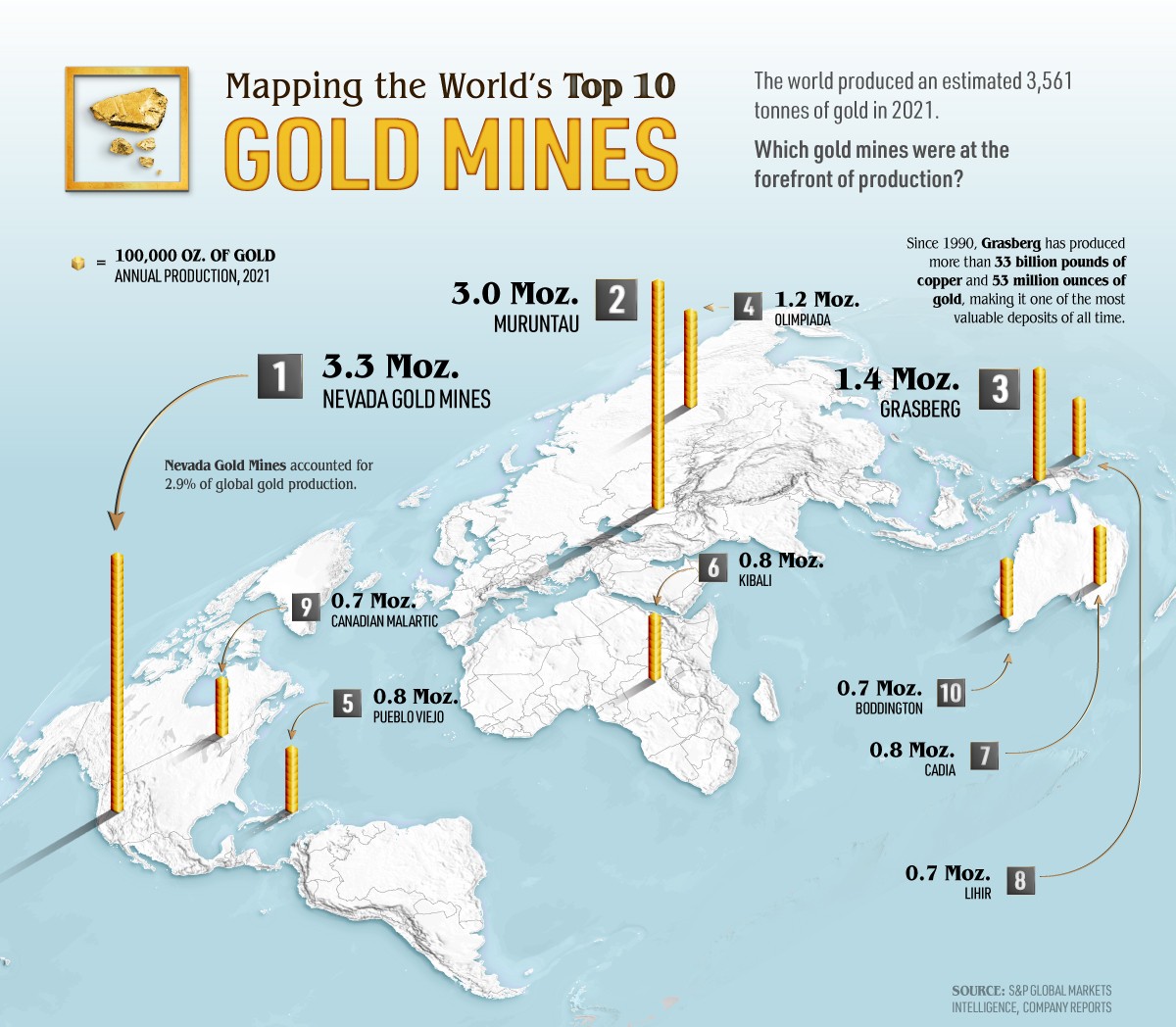

This recently from Visual Capitalist shows the World’s ten largest gold mines by production operating today. Perhaps the most unusual is Lihir in PNG in that it started life back in 1995 as a project financing of considerable daring. Features included:

- Significant dewatering issues in that the open pit was to be dug in a (hopefully) extinct volcanic caldera on the coast yet below sea level; processing facilities and all support infrastructure needed to be built in one of the most remote corners on Earth (due east, the next land is Ecuador 15,000 km away); and five types of ownership rights were involved (freehold, leasehold, three types of hunting rights) held by mainly illiterate local inhabitants.

- … All on top of the usual ESG issues common to all mining.

- Then there was the political risk. Rio Tinto’s Panguna copper mine on nearby Bougainville island was closed at the time due to the conflict between the PNG government and landowners there. (Only now might it reopen.)

- Benefits generated by the mine, both monetary and non – monetary, needed therefore to be shared across all levels of society. This wasn’t even a frontier market.

- Against this risk profile, $300 million of limited recourse debt was raised led by UBS with a condition precedent that a $450 million IPO led by Rothschild was successful. Only gold bugs would have taken on risk like that!

- There were three utterly different sponsors (with utterly different Completion Guarantees): Rio Tinto would need to get everything built and operating but then wanted to exit; NML was a second board Aussie with nothing else to contribute; and MRL was the government’s equity holding arm.

- Political risk insurance came from Australia’s EFIC, Canada’s EDC and the World Bank’s MIGA. The gold hedging was very good business (for the banks).

Yet it worked. Via various refinancings, Rio exited the project in 2005 (it finally gave up on Bougainville in 2016); Lihir merged with Newcrest in 2010; facilities were expanded; and the mine is still going strong. More info here, here and here.

Whilst at UBS, I spent a complete year leading the negotiations on the debt for Lihir. Many “war stories” ensued but, unlike much of banking which can be utilitarian or contentious, one of the joys of project financing is seeing the tangible benefits that it brings into the real World.